What Are the Advantages and Disadvantages of Starting a Nonprofit Organization?

A nonprofit organization is an organization that operates to serve other individuals, groups, or causes. Nonprofits do not operate to generate individual profit or gains. They do not distribute their profits to individuals who control the organization such as its members, officers, directors, or trustees.

Although a nonprofit organization can make a profit, any profit earned must go toward the core missions of the organization and not toward personal benefits. Read more about how to start a nonprofit here.

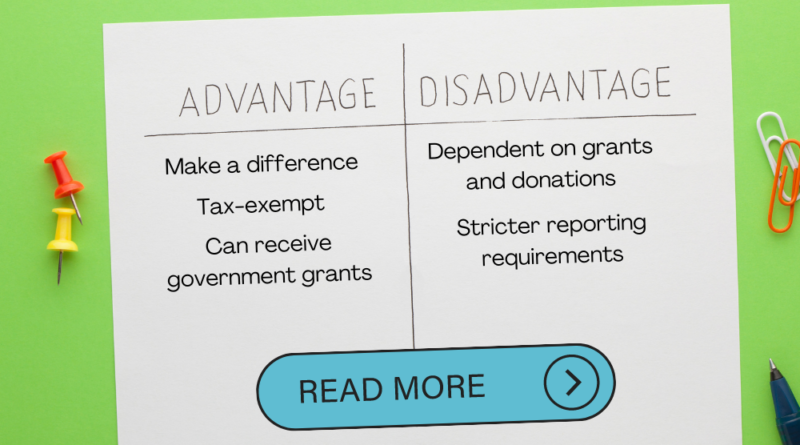

The Advantages of Starting a Nonprofit

- The first and in my opinion, the most important advantage of starting a nonprofit is you are serving others, you are effecting change, you are enhancing someone’s life.

- Because nonprofits are not intending to earn a profit, they usually have significant tax advantages over for profit-making businesses. Most of the income of a non-profit is tax-exempt. In the majority of cases, the contributions from donors are also tax-exempt.

- Nonprofits are structured like an LLC, therefore it limits the personal liability of its members and employees. Since the individual founders of the organization are kept separate from the business structure, their personal assets are not at risk in the case of a lawsuit, fine, or debt. The only issue that pierces this shield is if the members act unethically or illegally.

- The legal status remains intact even if the founders of the nonprofit are no longer apart of the organization. That makes it possible to continue the mission of the nonprofit long after the founders are gone.

- Nonprofits give people a chance to earn a living while doing something that offers a positive impact on the lives of others.

- Nonprofits often get better rates from government entities such as USPS. Also, many large corporations like Google, Facebook, and Amazon make special allowances for NPOs.

- A nonprofit organization can receive government, federal, state, local, and foundation grants and funding to further their cause.

The Disadvantages of Starting a Nonprofit

- Most nonprofits are dependent on grant funding and donations to survive. With over 2 million nonprofits in the U.S., obtaining a grant is extremely competitive and the application process can be complex. Nonprofit members are constantly soliciting donations and sometimes, this detracts from their main mission.

- Nonprofit organizations are subject to stricter reporting requirements and they are closely scrutinized. They are often required to report how they use their funds, with main focuses on their services and not administrative expenses.

- If the incorporators decide to move onto some other pursuits, they cannot take the assets accumulated by the nonprofit organization. Assets that are accumulated by the company, or put into the company by the founder, are not permitted to leave when they leave.

- The cost to apply for federal tax-exempt status can be prohibitive. The application fees of a nonprofit organization are determined by the budgeted annual gross income. Currently, the 501(c)(3) application fee is about $400 for NPOs with an expected yearly income of less than $10,000. Nonprofits with gross yearly incomes of $10,000 or more must pay an application fee of $850.

- Most find the application process to be complex and tedious. To ensure accuracy, it’s sometimes necessary to hire attorneys to help complete the application. This may not be in the budget.

- Nonprofits run the risk of losing their tax status if they miss the deadlines for filing their annual reports. If an organization misses its annual reporting deadline, then they may not be allowed to continue qualifying for their tax-exempt status. Even the statements themselves must meet specific requirements to qualify as an authorized filing.