New Feature: 990s are Now Available on GrantWatch!

We are all super pumped to be able to tell you that the most recent 990s are now on GrantWatch.com. Our staff is very busy interpreting the data for you and transforming it into pie charts, bar graphs, and lists of who the foundations have previously funded. We, at GrantWatch, are going to GIVE YOU MORE. Our response to inflation is not to raise our prices, but rather to work harder for you, our subscribers.

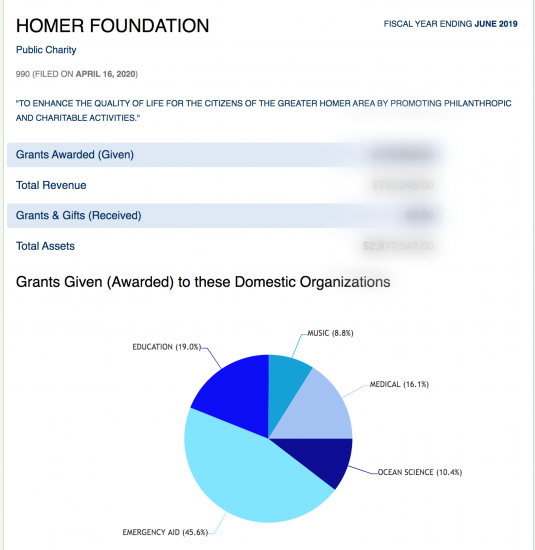

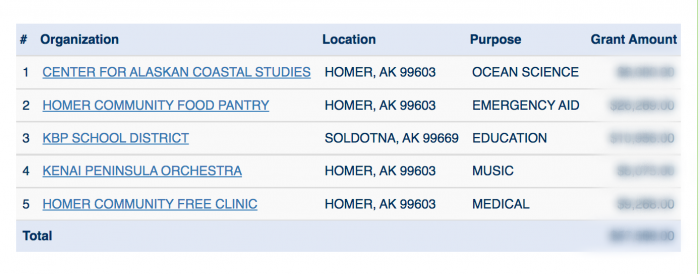

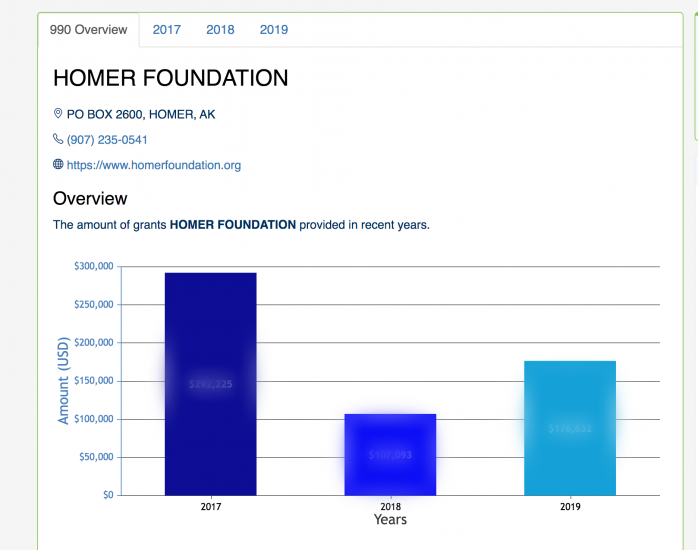

Our new foundation search engine with 990 reports: identifies foundations that have given grants, their location, their mission, the purpose of awarded grants, award amounts, names of nonprofits funded, foundation assets, revenue, key staff and board members, allocation of time, and compensation. In many cases, subscribers can click on the names of nonprofits funded to read their mission statements. You will also get a snapshot of the foundation’s financial health.

GrantWatch is unique in the way that it saves you time and energy by displaying in detail only currently available grants. With even more knowledge about the funding sources, you will be able to make a more informed decision as to whether you should or should not apply for a grant.

Grant writing is labor intensive, so it is best to first check on GrantWatch if your organization is eligible for a particular grant. Then, look at the foundation’s history to determine if you fit its mission.

Whether we depict the data graphically for you or present you with the latest IRS 990 filings, you will be able to see the areas of interest of a foundation by looking at the purposes of its previously awarded grants, the amounts awarded, the names of the nonprofits it funded, the foundation’s assets, revenue, key staff, board members, and allocation of their time and compensation. In many instances, you will be able to click the names of the nonprofits they funded to read their mission statements. You will also get a snapshot of the foundation’s financial health.

What Does This Mean for You?

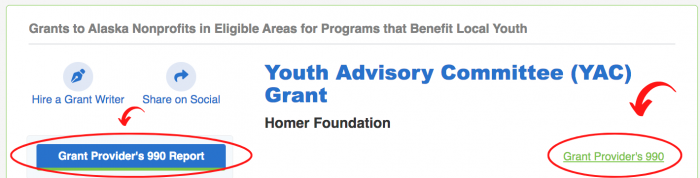

What does this mean for you, the grant seeker? With focused, onsite quick research, one click leads to better-informed decisions before starting an application.

As you know, GrantWatch.com is the leading grant listing directory comprised of grants from federal, state, and foundations, with close to 8,000 active grants currently accepting applications. This number varies daily and often reaches as many as 8,500 grants. This is because new grants are published daily from Sunday through Thursday, and expired grants are archived daily.

We looked at the 990s from the point of view of the applying organization and the grant writer’s need to zero in on data pertinent to grant writing. We started the rollout about a month ago and now have thousands of grants linked to their funder’s 990s.

With the 990s, you will no longer have to search through every piece of IRS data for what you need. We want you to spend your time writing and winning grants.

When you look at a private charity foundation’s 990 reports, look at the monetary assets from their last report and do the math. The minimum distribution will be 5% of those assets unless the grant application identifies a funding amount or number of grants.

If there is something you want to suggest about an item you want to see highlighted, we want to hear it. Please call or write to GrantWatch through the Contact Us page on the website. I just love the GrantWatch community which challenges us with new ideas that make us work harder, smarter and better.

We are also working on the current grants calendar, with new features forthcoming. Let us know what we can add to help you in your grant searching and grant writing. With this economy, you will be turning to us and we will be there for you. No “shrinkflation,” we will give you growth at GrantWatch.com

What Is a 990?

Tax-exempt organizations must file a tax return called a 990. It is filed annually by nonprofits with the IRS to comply with federal regulations. There are different variations of 990s: public charities file a Form 990, 990-EZ, or 990-N; whereas private foundations file Form 990-PF (PF stands for Private Foundation).

It may seem daunting at first, but the foundation’s tax form is surprisingly easy to read. A 990 will tell you things like

- The size of the foundation (assets);

- How much the foundation awards each year (dollars);

- How many awards it gave in the past year (number);

- Who received those awards, what was their purpose, and what was the dollar amount of each award?

This information will give you additional insight into the number and size of awards, as well as the type of organizations that a particular foundation has funded in the past.

How Can 990s Help With Your Grant Search?

The most crucial section of the 990 to grant seekers is Part XV, lines 3(a) and 3(b). This section will detail the complete list of grants paid and approved. This area is of interest to grant seekers, as it offers a look into the types of grants and grantees favored by the foundation. This information includes:

- The name and address of each grantee;

- The amount of each grant;

- The foundation status of each recipient (public charity, private foundation, non-charity); and

- The purpose of the grant.

Overall, 990s can tell you the grants made, to whom, and their size. Looking at this info helps you decide how much to ask for in your proposal. It also assists you in staying within the range of awards granted by this foundation. For example, you wouldn’t ask for $60,000 if they usually give only $15,000.

Also, you can use the 990s to match your nonprofit with the interests of any foundation you seek money from. You wouldn’t request a grant from a foundation that only seems to give money to community food banks to fund your technology project.

When seeking money from a foundation, it’s in your best interest to learn as much about that funder as you can. The 990 is one way to do that. We are very excited to help, and hope you use this new feature on GrantWatch.com!